My Debt Story

When my husband and I got engaged my finances were okay. I’d taken a year off work to be with my son, but my lack of income was supplemented with social security benefits. Because I’d lived with my parents during that year, I’d been able to sock away enough for a down payment on a house, but I didn’t have much else in savings.

I’d gone back to work that year, changing industries from marketing to supply chain. I was starting out at an entry-level salary, but it was enough to pay for the basics and put my son in daycare.

I didn’t bring any debt to the relationship. My dad had funded my undergrad, and I’d paid my way through my master’s degree. My car was paid for, I paid my credit card off every month, and I had about $30k in a retirement account. I was very privileged, and the finances looked alright on paper.

My husband’s finances were in a different place. He’d recently graduated with his master’s degree and had about $70k in student loans and about $2k in personal loans. Life had been tough for him and his young son, and like me, he was in a season of starting over.

We were in love, and we were ready to be a family. For better or worse.

Then I got sick. I contracted a pretty gnarly case of salmonella that became septic in my body. I was in the hospital for a week, to the tune of $20k.*

Heads in the Sand

Shortly after getting married, we had another baby. Between the hospital bill for her birth and my 4-month unpaid maternity leave, we’d racked up some joint debt. About $8,000 more in medical and $12,000 in credit card debt.

So there we were, suddenly deeeeeep in debt with three kids under six and a brand new mortgage.

Life had thrown some curveballs, sure. But I’d also buried my head deep in the sand, unable to face this new financial reality. It was the first time in my life that I’d felt out of control when it came to money. Life was forcing a pivot, whether I was ready or not.

When our daughter was about 6 months old, we decided to pull our heads out of the sand, take a good hard look at our money, and make a plan. We enrolled in a personal finance course at our church for learning and motivation. And it changed everything.

The Great Reckoning

The first session of the course centered on debt. It was the slap in the face we needed.

We corralled all our debts in a list. Before that day neither of us really knew how much we collectively owed to whom. Seeing that total land at six-figures was absolutely soul crushing. $112,000, not including the house.

How had we let it get so bad? How had we put ourselves and our tiny kids in this situation? Was there any possible way of climbing out of this hole?

After the tears were dry and tissues were tossed, we got to work on a vision.

The Vision

We wanted to get out of debt, yes, but bigger than that we wanted to transform our family’s future. We wanted to be a family who was smart with money, who operated inside a budget, and who built wealth for our future and our kids’ future. We wanted to retire someday and be self-sufficient.

A long road lay between where we were then and where we wanted to be. So we mapped our route, starting with eliminating the debt.**

The Plan

We made a plan to tackle one debt at a time, focusing on our highest interest debt first (this was the debt that cost us the most to carry) while making minimum payments to all other lenders. Once that debt was gone, we’d roll those extra dollars into to next highest interest debt, and so on…

In personal finance this strategy is called the Avalanche Method, and it’s what I most often recommend for paying off debt.

Our highest interest rate was on the $12k in credit card debt. The interest was about 18%.

Before The Great Reckoning, we had set aside about $10,000 in a savings account (an HYSA, of course) without any intention for that money. Looking back, it didn’t make much sense to save so much while racking up credit card debt, but this illustrates the dark side of my saver mentality. “Fake saving” gave me the illusion of control. In hindsight I realized it was just a way of pretending like things were fine when they weren’t. Watering the grass while the house is on fire, so to speak.

We withdrew most of that savings and threw it at the credit card, reserving some in savings for emergencies. Then each month, every penny that was left over after bills & minimum payments went to the credit card. It was down to zero in three months.

Then we rolled that payment to eliminate the $2k personal loan at 12% interest. That burden was also gone quickly.

And we kept going, aggressively tackling one debt at a time. Dreaming big, starting small.

Budgeting

Not gonna lie here. The budget was tight. We pared it down to the bare minimum.

The upside of bare bones was that we learned how to be creative inside of our boundaries. Most of our vacations during that season were road trips to stay with family and friends out of town. We shopped at Goodwill for clothes and Aldi for groceries. We rarely ever ate out.

The downside? Well… It sucked to have a tight budget. We’d look around at friends, family, and coworkers upgrading to bigger houses, buying expensive things, taking their kids on lavish vacations, and we were often envious. We argued, cried, pitied ourselves, and made mistakes out of fear and stress. We nearly threw in the towel countless times. At times it just seemed like too much sacrifice.

But instead of quitting, we pivoted. We’d put ourselves on a 3.5-year track to pay off all the debt, but that plan had tightened our budget to an unrealistic level. It stressed us out too much and made it difficult to work as a team.

So we took a good hard look and decided we could preserve our peace.

Paying off $100k is paying off $100k, whether it takes 3 years or 10. And having room for life in our budget was worth the extra time to us. So we made our monthly budget more realistic and extended the debt repayment timeline.

Increasing Earnings

My husband worked overtime and I landed promotions. Every raise, every bonus, every overtime check, every monetary gift from family, EVERYTHING extra went to obliterating the thing standing between us and the life we wanted.

Through it all we knew becoming debt-free was our priority. It was the biggest obstacle between us and our shared vision. And while it was a slog, we trusted it would all be worth it in the end.

In February 12, 2020 (four years ago today!), we made our very last debt payment.*** After 4.5 years, we were finally debt free!

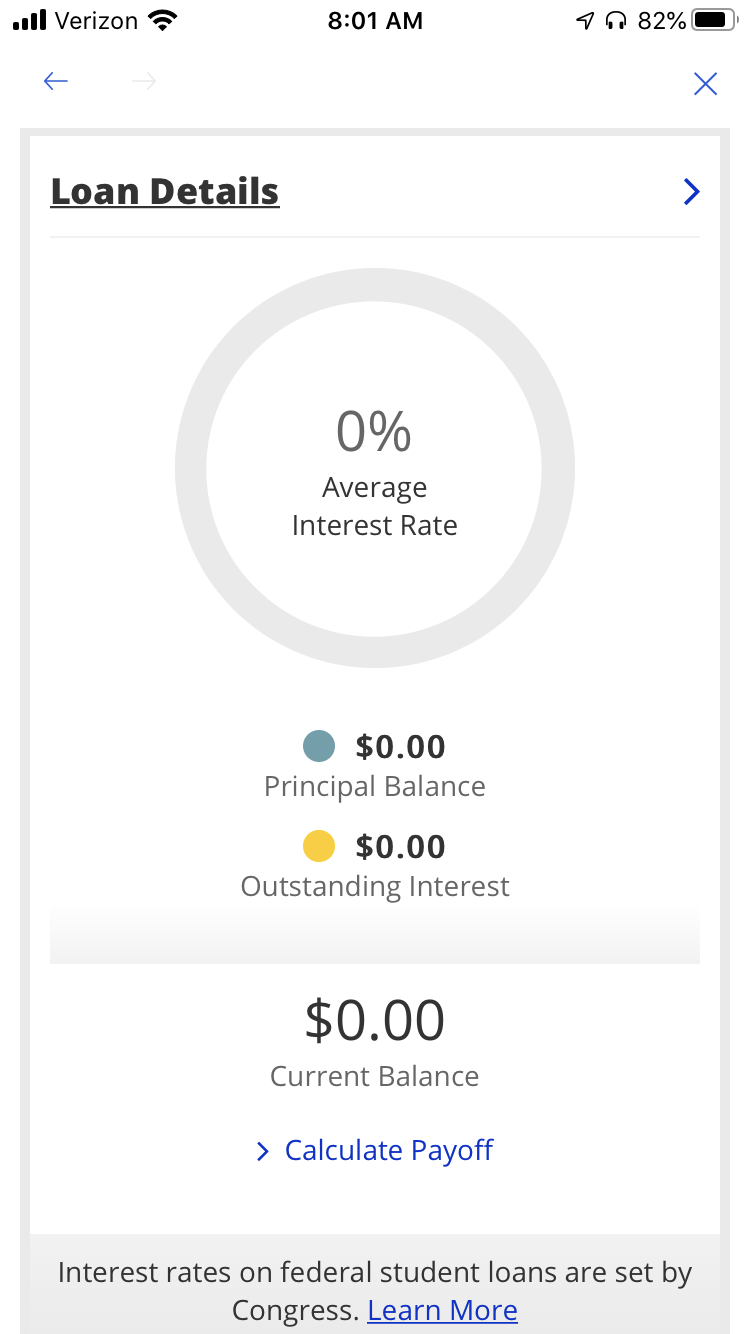

A screenshot I took the day I saw that zero balance on the last debt

Y’all. We celebrated like we’d tasted freedom for the very first time! We memorialized the milestone with a long-awaited vacation (in a hotel!), just the two of us. We ate oysters and drank beer on the beach in February. And that fall, we took our kids (and our Covid masks) to DisneyWorld! We paid for all of it in cash.

Today we have more margin in our budget. It’s been lovely to loosen the reins and spend a little more than we used to. But we’re also saving regularly and aggressively investing for our future. Even though we cleared a couple big hurdles, we still keep our eyes firmly fixed on our vision.

Our debt-free celebratory vacation in February 2020

Do you have a debt story? Please share as much or as little as you like — no shame, only connection. That’s what I’m about here at Beyond Budgets.

Want to tackle your own debt but overwhelmed or not sure where to start? It’s my specialty, so you’ve come to the right place. Reach out and let’s create a plan for you!

Footnotes:

*We would happily pay that $20,000 all over again. The team at our hospital saved my life, and we can’t put a price on that. Just sharing to paint a picture of where we were financially at that time.

**I should note that we had (and still have) active term life insurance policies to protect our family. If we hadn’t, that would have been step number one.

***We do still have a mortgage. We refinanced from a 30-year into a 15-year mortgage in 2021 when rates were insanely low. We plan to keep our mortgage until it matures or we decide to sell our home.