Everything I Spent in January

This year I plan to share with you what we spend in our household each month and why.

Reasons for sharing this with you all are two-fold. 1) It holds me accountable - accountability is a very important pillar of healthy money habits. And 2) it fosters a community of openness and transparency here on my site, which is my goal. If we talk about money, we all grow more comfortable with it. So I’m putting my money where my mouth is... 😏

We are 39/40 year old dual income family with 3 kids ages 13, 10, and 8.

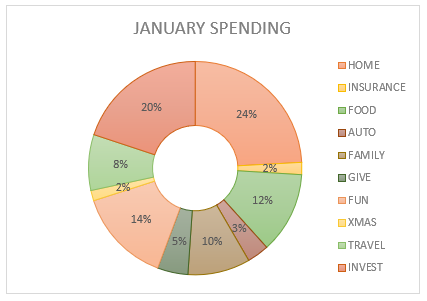

Some expenses will be shown as percentages while others in U.S. dollars. Here’s the nitty gritty.

Pivot Expenses (the unexpected…)

$3000 for a 3-month treatment plan at the chiropractor.

My husband loves his work. But it demands a lot from his body. Recently he’s experienced some pain and tension in his back, so he sought treatment. After x-rays and professional analysis we learned that his condition is treatable without surgery, but it will take time, work, and money to treat it.

Health is a critical value for us, and this same practice helped to heal my body pain two years ago. We trust them with our spinal health, so this was a no-brainer decision.

Paying for treatment in full saved us $800 versus a 3-month payment plan. We had the cash in an HYSA, so we paid up front.

Planned Expenses

Home: Mortgage + Utilities = 20% of take-home pay

We are lucky that our housing costs are relatively low. We bought our home 10 years ago, before 3 bed/2 bath homes in our area were commanding at least half a million dollars. Could we use an additional bedroom and an office with a door? Yep, absolutely. But for now it matches our values and budget to stay put and invest the difference.

Home: Repairs & Services = 1%

Fortunately there were no surprise repairs this month. We pay a monthly fee for our plumber/HVAC/electrical and pest/termite control. We set aside $200 per month in a savings account (shown below in the savings categories) to tackle any unexpected car or home repair bills that arise.

Home: Supplies = 3%

This includes non-food supplies like paper towels, toilet paper, laundry & cleaning stuff. We also lump in our pet food & supplies for the dog & our 9 chickens. We had some extra expenses in the category with extra chicken feed for the super cold days, fresh coop bedding, and a new long-lasting flea collar for the dog. Overall, we were on budget.

Home: Subscriptions = <1%

This covers our streaming services like Netflix and HBO, our printer ink, WSJ online, and Southern Living magazine subscription (it’s my husband’s favorite, my sweet southern gentleman).

Insurance = 2%

This includes our auto and term life insurance policies. Home insurance is in escrow and included in our mortgage payment.

Food = 12%

It snowed here in the south, and we were homebound for several more days than planned. Because we were all home, we ate at home more. As a result we went over our usual grocery budget by about $100. However we were under on our dining out budget by the same amount, so we balanced out across the food category.

Auto: Gas = 3%

Because of the snow storm, I didn’t drive to my office as much this month, so we came in a little under budget here.

Family: Kids = 6%

This covers their pay days, school lunches, field trips, and family activities. In January our middle son took a trip with a friend to a local science museum, our oldest went to a movie with friends (funding some of it himself), and the youngest two kids and I went roller skating. The rest of the month the kids played in the snow, hung with friends, and spent time at home.

We paid some summer camp deposits last month, so we went over budget by a few dollars. We split the remaining amounts for these camps into the spending plan for the next few months.

Family: Health = 4%

This category includes doctors, dentists, and therapy.

Because we were able to pay for the expensive chiropractic treatment plan with savings from our HYSA, this line item stays where we planned it for the next few months. We always pad this budget by a couple hundred dollars to allow for surprise doctor visits. While we didn’t sustain any sick visits this month, my therapy bill hits twice some months (it’s a 4-week payment cycle instead of monthly), and January was one of those months. Fortunately we had that extra padding and stayed under budget.

Giving = 5%

We give a portion of our income to organizations we believe in each month. This month we gave to our brother’s church out of town.

Fun Money = 14% of income

My husband and I each have our own budgets for stuff we love, like, and want. Each one (his & mine) is tight enough that we do have to keep an eye on them but also loose enough that we’re not stressing over every single dollar or discussing every expense.

That said, we went a few dollars over our fun money budget in January. So we made a plan to make up for it in February.

My Fun Spend - Specifics:

One of my spending values is my hair. It gives me confidence and joy to care for it. In early January had my quarterly hair salon visit for full highlights and a cut. Even though I used almost half my fun money budget on that visit, I regret nothing. I planned for it and my hair is now glorious bright blonde again - just the way I like it.

I also paid for some annual subscriptions this month that won’t be recurring. I really value podcasts - they entertain me on my morning walks and keep me company on the way to the office. My favorite podcast has a paid membership tier with bonus content that I now cannot live without. Last year I paid for it monthly, and this year I opted to save about 10% and pay once a year.

I also bought a few books. We love libraries but we’re also big book collectors here in the Traverse household. Owning books is an important value to us.

I splurged a bit on some makeup and a stylus for our family iPad, too.

Savings & Investments

Short term Savings:

$915 for Vacation Fund

Our next trip is in just a couple months, so we were a bit more aggressive here than usual.

$200 for Repair Fund

Saving for that inevitable car trouble or home repair. This fund is crucial for our peace of mind.

$170 for Christmas 2024

We set aside a bit each month for the most expensive time of the year. This fund has saved us loads of holiday headaches through the years.

And these funds are all three kept in HYSAs, so that saved money earns interest!

Investments = 20%

$1,166 for 2024 ROTH IRAs (mine + my husband’s).

For those who qualify, the 2024 max ROTH IRA contribution is $7,000, which is $583 each month. My husband and I each have a ROTH account, so $1,166 per month is our plan.

Our 401k and HSA investments are taken out of our paychecks before tax.

The leftover bit of that 20% went toward our kids’ 529 investments for post-high school education. Whether they want to go to college or trade school, we’ll have a chunk of money set aside to help out when that day comes.

That’s it. January is in the books!

Overall, we had some expensive surprises, some overages, and some windfalls last month. We managed through it as a team, and we’re genuinely proud of that.

Have you ever managed your expenses as percentages rather than dollars? If so, does it help see where and how you’re spending with more clarity?

How did your January spending go? Let’s all learn from the fails and celebrate the wins!