Everything I Spent in March

This year I plan to share with you what we spend in our household each month and why.

Reasons for sharing this with you all are two-fold.

1) It holds me accountable. Accountability is a very important pillar of healthy money habits.

2) It fosters a community of openness and transparency here on my site, which is my goal. If we talk about money, we all grow more comfortable with it. So I’m putting my money where my mouth is... 😏

We are 39/40 year old dual income family with 3 kids ages 13, 11, and 9.

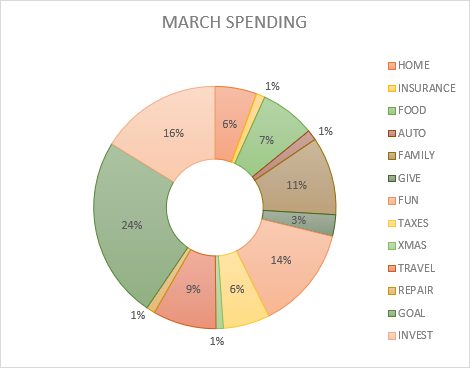

Some expenses will be shown as percentages while others in U.S. dollars.

This month’s income was higher than usual. It included my annual bonus from my corporate job, so of that bonus we decided to save 60%, use 20% for our income taxes, and spend the remaining 20% of that bonus payout.

Our numbers look a bit different than usual this month, due to that once-a-year windfall.

Pivot Expenses & Surprises (the unexpected…)

Taxes… we knew we’d have to pay a bit, we didn’t know exactly how much until we got all our filing documents in early February. It wasn’t too bad though. Everything was filed in February, and the payment was auto-drafted the same day my bonus cleared on March 1. Out of sight, out of mind.

We also made a change to our travel plans for our upcoming vacation. We’d planned for my husband to drive and the kids & me to fly; however, we changed the plan, rented a larger vehicle and will all drive instead. Family road trip! 🚙

Planned Expenses

Home: Mortgage + Utilities = 2% of take-home pay

Our mortgage loan changed hands, and our payment timing changed. Consequently we didn’t make a mortgage payment in March, which was a fun surprise!

Our utilities, however, included some less positive surprises. Each was a smidge higher than expected, and all in we exceeded the budget by about $40.

Home: Repairs & Services = 1%

We had no unusual repairs this month. Fortunately when my husband cranked up the lawnmower for the first time of the season, it started right up!

Home: Supplies = 2%

We had to replace a hose that burst over winter, but otherwise no real surprises. We came in under budget.

Home: Subscriptions = 1%

Amazon Prime annual renewal was this month, and it was planned for and covered.

Insurance = 2%

This includes our auto and term life insurance policies.

Food = 7%

We came in right at budget for dining out and groceries this month. My husband and I had a fun date night out with friends, the kids got a few trips to restaurants, and we had plenty of yummy home-cooked meals with lots of leftovers.

Auto: Gas = 1%

We traveled out of town for funeral in early March. My husband took the kids on a weekend getaway to visit family in late March. Otherwise there was nothing unexpected in the fuel category. I had a few more work-from-home days than in a typical month, so that saved us a few bucks on gas.

Family: Kids = 10%

We increased this budget for March. After reviewing earlier in the month, we decided to rearrange some budgets to make more room in the kids’ category.

AND WE STILL WENT OVER. There were some school fund raisers and clothing for vacation in addition to increased school lunch budgets and summer camp fees.

These kids are expensive. Thank goodness they’re so cute.

Family: Health = 1%

This category includes doctors, dentists, and therapy.

We didn’t have any doctor visits or unexpected medical expenses in March.

Giving = 3%

We give a portion of our income to organizations we believe in each month. This month we gave to Second Harvest Food Bank, an organization dedicated to helping provide food for people facing hunger in our area. Like our donation last month, my employer offers a 1:1 match for this donation, so together we were able to donate 4,000 meals for locals in need.

Fun Money = 14% of spending

My husband and I each have our own guilt-free budgets for stuff we want. Each one (his & mine) is tight enough that we do have to keep an eye on them but also loose enough that we’re not stressing over every single dollar or discussing every expense. It’s a good balance for us.

We took $1000 from my bonus payout and split it to add to our March fun money. We made this month extra fun! 😎

My Fun Spend - Specifics:

With my bonus spending, I got my eyebrows shaded/microbladed. This is a cosmetic procedure I’ve wanted to have done for years, and my husband has been encouraging me to do it (I assume mostly because he’s tired of hearing me talk about having it done). I have very light, very sparse brows, and I have long relied on makeup to help me look less like an alien. 👽 I loved the artist who did the procedure, and it was a great experience. Plus I can finally ditch my eyebrow pencils with confidence!

Another big ticket item was a walking pad for my home office. It sits beneath my adjustable height desk, so I can walk while I work. I love how easily I can get to 10,000 steps each day now!

Taxes = 6%

We had to pay our income taxes this month, so as mentioned we used a chunk of my well-timed bonus.

This wasn’t a happy accident. My bonus falls at the same time each year, so while we may not always know the exact dollar amount, we can project an estimate based on previous years. Ever since paying off our debt, we’ve had more flexibility with this additional income, so we plan to pay a portion of it for our annual tax bill. It’s a huge relief to know we’re not going to have to scramble to find those extra dollars in April.

Savings & Investments

Short term Savings:

$1450 for Vacation Fund (Travel)

We used it pretty much immediately for our trip!

$200 for Repair Fund

Saving for that inevitable car trouble or home repair. This fund is crucial for our peace of mind.

$170 for Christmas 2024

We set aside a bit each month for the most expensive time of the year. This fund has saved us loads of holiday headaches through the years.

$4,300 for Goal Fund

The majority of my bonus was socked away in our Big Dream Fund for our someday home in Florida.

All these funds are all kept in HYSAs, so that saved money earns interest!

Long Term Investments = 16%

$1,166 for 2024 ROTH IRAs (mine + my husband’s).

{For those who qualify, the 2024 max ROTH IRA contribution is $7,000, which is $583 each month. My husband and I each have a ROTH account, so $1,166 per month is our plan.}

Our 401k (traditional IRA) and HSA investments are taken out of our paychecks before tax.

The leftover dollars went toward our kids’ 529 investments for post-high school education.

My oldest son and I sat down mid-month, talked through investing basics, and once a week we check the Fidelity app and talk about how his college investment is doing. It’s a very cool way to show him the power of investing and teach him to be comfortable with investing on his own someday.

That’s it. March is done!

We had more windfalls than expenses last month. And instead of going hog-wild spending all that extra cash, we made a plan and executed it.

Please remember — It has taken us a decade of ups and downs to fine tune the numbers and get on the same page with our budget, and while we’re nowhere near perfect (we have to pivot somewhere every single month), we are making great strides.

Budgeting is a marathon not a sprint, so take it easy on yourself if your numbers didn’t add up the way you’d expected. Allow for grace. Reflect, learn, and adjust.

How did your March spending go? Let’s all learn from the mistakes or surprises and celebrate the wins!