Saving Money: Beyond the Obvious Benefits

Saving money has many advantages. Having a stock pile provides a safety net, provides flexibility to pivot, and allows your future self to retire from work comfortably. But this habit also extends beyond the obvious perks. Let’s talk about some less obvious ways saving money can greatly impact your financial well-being — from the practical to the psychological.

Taxable Income: The Silent Saver

The first overlooked benefit of saving money is its impact on taxable income. Gah, taxes are boring. But stay with me because this is actually pretty cool.

Contributions to tax-advantaged accounts, such as a 401k, 403b, or an IRA, can lower your taxable income for the year, meaning you pay less in taxes while earning the same. By strategically maximizing these contributions, you not only save for the future but also reduce your tax burden. It's a win-win scenario that not only benefits your savings but also helps keep more money in your pocket now.

A simple example. If my income was $50,000 last year and I used it all, my federal tax bill will be $6,300 for 2023.* But if instead I saved $1500 straight into a 401k account, then my taxes would only be $5,980. That’s $320 less! I didn’t make less money, but I paid less in taxes by setting some aside? Yep, exactly.

Compound Interest: The Snowball Effect

Interest is passive income, meaning you’re earning money for no effort. All you have to do to take advantage of this type of passive income is save.

Compound interest is passive income on your passive income.

Using an interest-yielding savings account allows you to not only earn interest on your initial contributions but also on the interest on that interest. This compounding effect can lead to substantial growth over the long term, like a rolling snowball.

How can you earn interest on your saving while keeping that nest egg accessible? A high-yield savings account. These are online savings accounts that return up to 5% interest (as of Jan 2024), while keeping your money available for emergencies or planned expenses. My favorites are Sofi and Capital One Performance Savings, but there are many more options online.

I use HYSAs for my emergency fund, my kids’ savings accounts, our family vacation savings, and even our Christmas savings account.

You know anyone whose savings strategy is keeping a bunch of cash under their mattress? (Are you that person?) While saving is great, that wad of cash socked away is missing out on the opportunity to generate passive income.

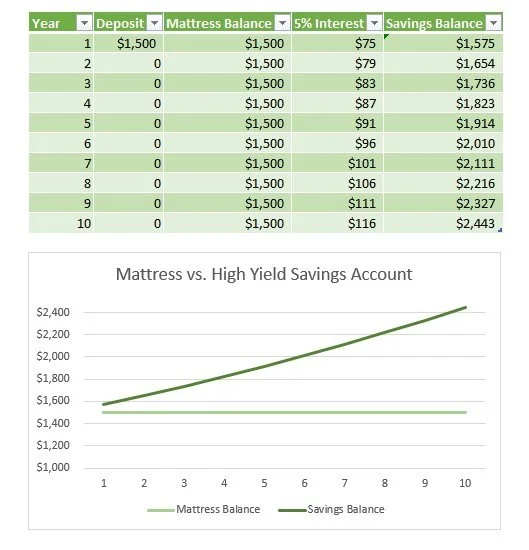

Here’s a compound interest chart to illustrate this example. Here we’re comparing two savings strategies starting with $1500 — 1) under the mattress (no interest) vs. 2) in an HYSA compounding at 5% annually (APY). Here’s what happens over the course of 10 years:

After ten years, the account earning interest has nearly $1000 more in it. And the only difference? One is in an HYSA and the other is not.

Company Matches: Doubling Your Efforts

Many employers offer 401k matching programs as part of their benefits package. This essentially means that your employer will contribute a certain amount to your retirement savings for every dollar you contribute, up to a specified limit.

Here’s an example. If my employer offers a 401k with a 3% match and I make $50,000 annually, that means that if I elect to put 3% of my salary in my 401k ($125) per month, the company also deposits $125 into my 401k account alongside me each month. So at the end of one year, I put in a total of $1500 and my company put in $1500, totaling $3000. That’s $1500 in free money, folks!

Take full advantage if you have the opportunity and you could double your savings without any extra effort on your part.

Out of Sight, Out of Mind: Behavioral Finance

There's a psychological aspect to saving money that goes beyond the numbers. The concept of "out of sight, out of mind" is a very powerful motivator for saving.

Automating your savings, whether through payroll deductions or automatic bank transfers to a savings account, ensures that a portion of your income goes directly to savings before you have a chance to spend it. This subtle approach helps strengthen your financial foundation effortlessly.

While the immediate benefits of saving money are clear, diving into the non-obvious advantages reveals a slew of ways in which this simple habit can significantly enhance your financial well-being. From reducing taxes to leveraging benefits, saving money proves to be a multifaceted tool for securing a brighter financial future.

Want to learn more about any of these concepts? Contact me and let’s dive in!

*Estimates based on 2023 federal tax brackets, single filing status, no deductions or allowances, rounding to nearest $10 for simplicity. Example only, not tax advice.