Everything I Spent in June

This year I’m sharing what we spend in our household each month and why.

Reasons for sharing this with you all are two-fold.

1) It holds me accountable. Accountability is a very important pillar of healthy money habits.

2) It fosters a community of openness and transparency here on my site, which is my goal. If we talk about money, we all grow more comfortable with it. So I’m putting my money where my mouth is... 😏

We are 40 year old dual income family with 3 kids ages 14, 11, and 9.

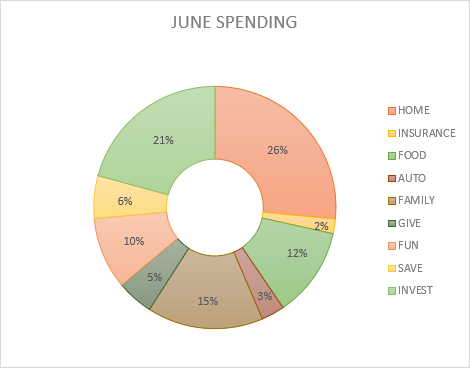

Some expenses will be shown as percentages while others in U.S. dollars.

Pivot Expenses & Surprises (the unexpected…)

This is the year of health expenses!

It all started when I experienced some pelvic pain over Memorial Day weekend. I called my doctor when offices reopened, and he recommended a CT scan. Then more visits. Then more imaging. Now we’re $1200 into the journey and no resolution in sight yet.

In the middle of my health struggles, my middle son caught a nasty case of strep throat during his camp week. Not a fun expense, but we’re thankful for good help from grandparents, good doctors, and good insurance.

Another fun pivot surprise cropped up when my daughter lost ONE SHOE during a hiking camp outing when she changed into water shoes for creek time. She carried her tennis shoes the rest of the hike and the pair became separated somewhere along the way. I discovered the lonely shoe later that evening and, as luck would have it, she had to have tennis shoes for the next day’s activities. So this momma cussed all the way to the shoe store and back… Bless. This. Mess.

Planned Expenses

Home: Mortgage + Utilities = 19% of take-home pay

Home: Repairs & Services = 4%

We had an annual renewal of termite & mosquito protection this month, taking up a bit more of the budget than usual.

Home: Supplies = 2%

Home: Subscriptions = 1%

Insurance = 2%

This includes our auto and term life insurance policies.

Food = 12%

We came in right under budget for groceries and dining out this month; a nice reprieve, since this category is usually a budget buster.

Auto: Gas = 3%

We were under budget for fuel this month with a few extra work from home days for me.

Family: Kids = 4%

Despite the shoe incident, we were right on budget for the kids this month.

Family: Health = 11%

Lots and lots of dollars to healthcare. We’re thankful for our caregivers and also for our HSA.

Giving = 5%

We give a portion of our income to organizations we believe in each month. This month we gave to a local organization who provides health services to the homeless population in our community. We have a close doctor friend who works for them, and we’re proud to support the organization.

Fun Money = 10% of spending

My husband and I each have our own guilt-free budgets for stuff we want. Each one (his & mine) is tight enough that we do have to keep an eye on them but also loose enough that we’re not stressing over every single dollar or discussing every expense. It’s a good balance for us.

My Fun Spend - Specifics:

I bought some summer clothing and some books. It was kind of a boring month of spending for me, to be honest. But I got joy from everything I spent money on. Even the little stuff.

Savings & Investments

Short term Savings:

$415 for Vacation Fund

$200 for Repair Fund

$170 for Christmas 2024

We set aside a bit each month for the most expensive time of the year. This fund has saved us loads of holiday headaches through the years.

All these funds are all kept in HYSAs, so that saved money earns interest!

Long Term Investments = 21%

$1,166 for 2024 ROTH IRAs (mine + my husband’s).

{For those who qualify, the 2024 max ROTH IRA contribution is $7,000, which is $583 each month. My husband and I each have a ROTH account, so $1,166 per month is our plan.}

Our 401k (traditional IRA) and HSA investments are taken out of our paychecks before tax.

The rest of those investment dollars went toward our kids’ 529 investments for post-high school education.

That’s it. Half of 2024 is now over!

In review we’ve spent quite a bit more than expected on healthcare so far this year. We’re grateful for our HSAs and for budgeting the way we have so that we can rebound from those expenses.

Please remember — It has taken us a decade of ups and downs to get on the same page with our budget, and while we’re nowhere near perfect (we have to pivot somewhere every single month), we are making steady progress.

Budgeting is a marathon not a sprint, so take it easy on yourself if your numbers didn’t add up the way you’d expected. Allow for grace. Reflect, learn, and adjust.

How did your June spending go? Let’s all learn from the surprises and celebrate the wins!